For most agents, writing a Homeowners' policy is as easy as riding a bike. They’ve done it hundreds, if not thousands of times, they understand the coverage, they have no trouble presenting it to their clients and they could complete the application in their sleep.

For most agents, writing a Homeowners' policy is as easy as riding a bike. They’ve done it hundreds, if not thousands of times, they understand the coverage, they have no trouble presenting it to their clients and they could complete the application in their sleep.

Writing Flood insurance is a different matter, more like riding a bike with a flat tire.

The National Flood Insurance Program (NFIP) requires more-detailed underwriting information than a standard Homeowner’s application. Understanding the NFIP guidelines, its flood maps, elevation certificates, coverage limitations and constant legislative changes can make for a bumpy ride.

Agents generally write Flood insurance in conjunction with a Homeowner’s policy when the property is in a designated Special Flood Hazard Area and the mortgage company requires coverage. Of the 90 million residential structures in the United States, approximately 10% are located in Special Flood Hazard Areas, yet only about half of those structures carry flood insurance.

“Because Flood insurance is written less frequently than Homeowners’ insurance and the coverage is quite different, some agents are not comfortable offering coverage,” said Keith T. Brown, CEO of Kalispell, Mont.-based Aon National Flood Services. “Which could be why after an event like Katrina or Sandy, you’ll often read that only a fraction of the affected property owners carried Flood insurance.”

Of the $3 billion in damages after flooding in Texas and Oklahoma that took 32 lives in May of 2015, approximately one-third was covered by flood insurance. Also last year, torrential rains resulted in a flash flooding in Colorado, causing $2 billion in damage, with less than 2% of losses insured.

“Agents probably explain to their Homeowners’ clients that flood damage is excluded from the policy,” said Brown. “Why aren’t they offering Flood insurance? As part of the industry intent on protecting the public from catastrophic financial losses, they should.”

Premiums in preferred zones are affordable and flash flooding can occur almost anywhere in the U.S. Property owners with homes in low to moderate risk areas account for 20% of the NFIP’s flood losses.

Comparing Homeowners and Flood insurance

As most Americans have a reasonable understanding of how their Homeowners' policy works, they often expect the same coverage on their Flood policy.

At minimum, agents should inform property owners that the NFIP Flood insurance does not include coverage for finished basements and additional living expenses. While the NFIP policy does not cover personal contents in a basement, it does provide valuable coverage for “footings, foundations, posts, pilings, piers or other foundation walls and anchorage systems required to support a building; stairways/staircases; furnace, hot water heaters, electrical junction, circuit breaker boxes electrical outlets and switches, etc.”

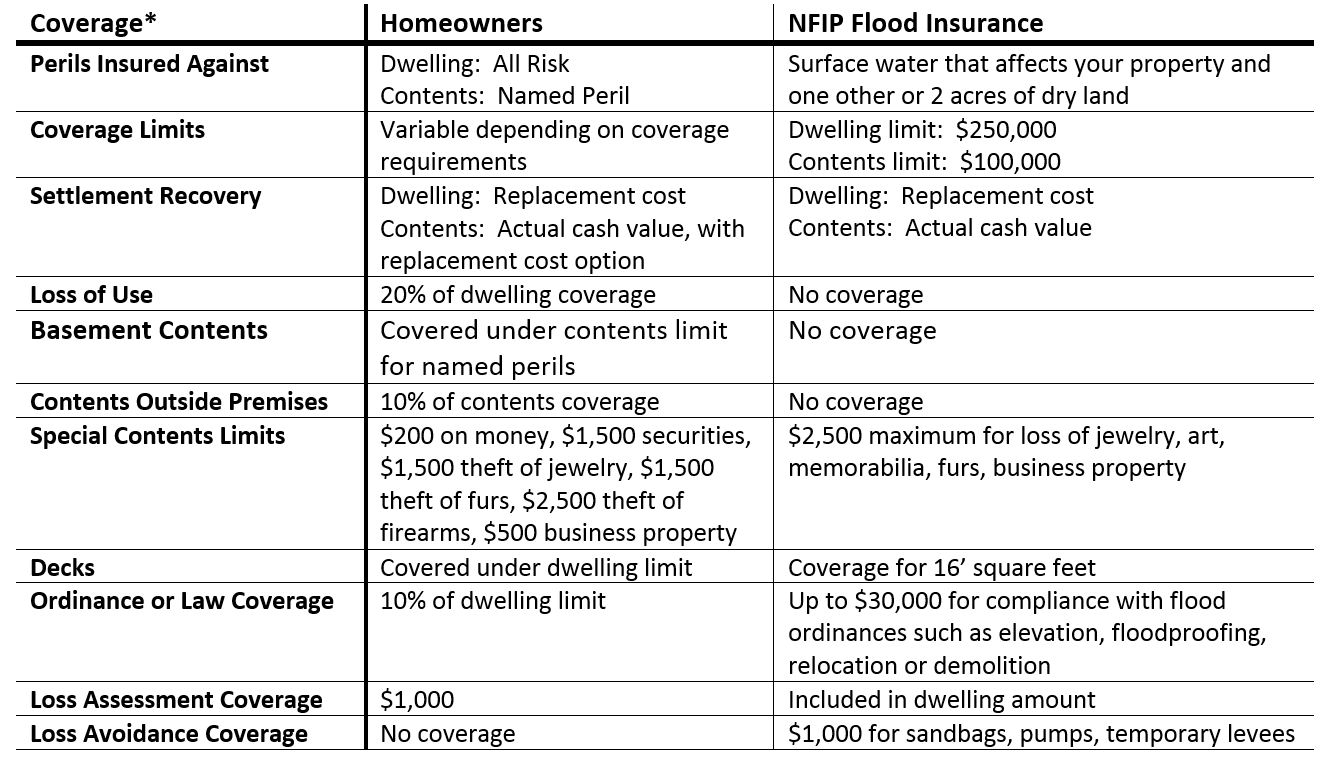

There are other differences between a typical Homeowners' insurance policy and NFIP Flood insurance as well. The chart below illustrates a few of the variations between the two policy forms:

Image source: PropertyCasualty360.com

FEMA regulations

With a $24 billion budget deficit on the flood program, FEMA is aware that it needs assistance. Recent legislation has paved the way for private industry to dip its toe into the Flood insurance marketplace.

A number of early entrants to the private market offered nothing more than the NFIP policy repackaged and discounted, nonetheless, they are industry pioneers that have helped pave the way. New technology and risk modeling tools are enabling the private insurance sector to create new primary flood insurance contracts that offer access to higher limits and simplified underwriting and application processes.

What can agents do to stem the rising tide of flood losses?

“By offering Flood coverage at the point of the Homeowner sale, in addition to offering protection to your clients from devastating losses, you’re also helping to protect yourself from potential errors and omissions claims,” said Brown of Aon National Flood Services.

Paula M. Keith, a client relations director Aon National Flood Services, agrees. “A large percentage of Errors and Omissions claims can arise from failure to offer Flood coverage. Whether it’s not offering uninsured motorist coverage (Auto), replacement cost on contents (Homeowners) or not offering Flood insurance, its failure to offer coverage.”

Other resources agents may wish to consult:

- FloodTools.com, offering flood maps, loss calculators, claimant videos and educational materials to educate agents and consumers on their flood exposures.

- FloodSmart.gov is another helpful resource that offers insights on the risk of flood and answers basic flood questions

- Flood insurance courses when they’re in need of continuing education credits

- View the NFIP Standard Flood Insurance Policy.

Offering Flood insurance to prospective and current clients will help agents expand their business and provide a layer of protection for catastrophic loss for their clients. It’s a procedure that every agency owner/manager should have in place. Providing continual flood education to their staff is key to insurance agents becoming comfortable with, and offering Flood insurance to their clients.

By Julie Duncan on PropertyCasualty360.com.